For most new businesses, back-office processes like accounting are last on the list. You figure out your products or services, pricing, payroll, and any number of other priorities before you get to financial record-keeping.

Which is understandable. But it won’t last for long.

Any business that wants to survive has to have a plan for accounting. That probably means hiring a professional, but founders also need to know the basics. Even if you haven’t got a clue where to start, you’ll need to figure it out - fast.

And we’re here to help.

This article is full of sound accounting advice for startups. You’ll find all the most important terms and processes you need to know, plus a few smart ways to get the whole thing moving faster.

Startup accounting 101

Let’s begin with a simple question: why should you care? Unless you’ve founded an accounting firm, bookkeeping isn’t what you’re here to do. It’s the part you have to do, if you want to keep doing the thing you’re actually here to do.

It may seem annoying, but clear books can actually be a wealth of information about your own business. They’re a great place to spot inefficiencies, ways to reduce (or increase) spending, and they’re the first thing any investor or bank wants to see before giving you more money.

In short, accounting tells your startup story.

And what’s more, it’s really not optional. Investors, banks, and the tax authorities all want to see your financial records. If you want to claim tax relief, you’ll also need to be able to prove where your costs are going.

So getting your accounting right is critical. And while there are plenty of deep and complex areas we could get into, this post sets out the primordial must-haves.

Startup accounting fundamentals

We’d best run through a few of the very basics when it comes to accounting.

What is accounting?

In a nutshell, accounting is financial recordkeeping. It involves measuring financial data, processing and interpreting that data, and then communicating it effectively to stakeholders.

How does it help?

As already mentioned, accounting isn’t optional. So it most obviously helps your business by making sure you meet essential requirements.

But that’s just the starting point. Good records help you make smarter business decisions. Until you know how revenue comes in and expenses go out, it’s difficult to use your resources effectively.

Who is involved?

Naturally, accounting is done by accountants. In truly tiny startups, these could be outsourced professionals, or simply the founders taking responsibility for it themselves.

Once your team is large enough, you may choose to have in-house accountants as part of a wider finance team. Or your finance team will liaise with outsourced experts.

Key stakeholders include:

Management, who need financial records to build business plans

Shareholders, who need to know that their investment is well-managed

Authorities, who need to know you’re not breaking the law

And in best-in-class companies, other employees also have an interest in financial data. They use it to create better products, identify ideal customers, and prove the overall value of their efforts.

Key startup accounting documents & data

Before we get into accounting strategies and tips, you first need to tick off a few crucial pieces of documentation. Almost no matter the size or type of business, you’ll need these.

1. The general ledger

Your general ledger is your company’s accounting information hub. It records every financial transaction undertaken by the company in its lifetime - both incoming and outgoing.

This includes:

Revenue

Expenses

Assets

Liabilities

Equity

Profits

Losses

Each of these is known as a ledger account, and will then likely be broken down into further detail, to identify credit card payments, employee expenses, payroll, and a huge range of other money streams.

The basic purpose - other than good record-keeping - is to be able to match credits against debits at the end of a certain period and have them balance.

If you find that the total value of credits across all ledger accounts does not equal the value of debits, an error has occurred.

2. The 3 essential financial statements

We’re cheating a little bit by lumping three documents together. But these financial statements are definite must-haves. And all the rest of our key documents relate to these three in one way or another.

Balance sheet

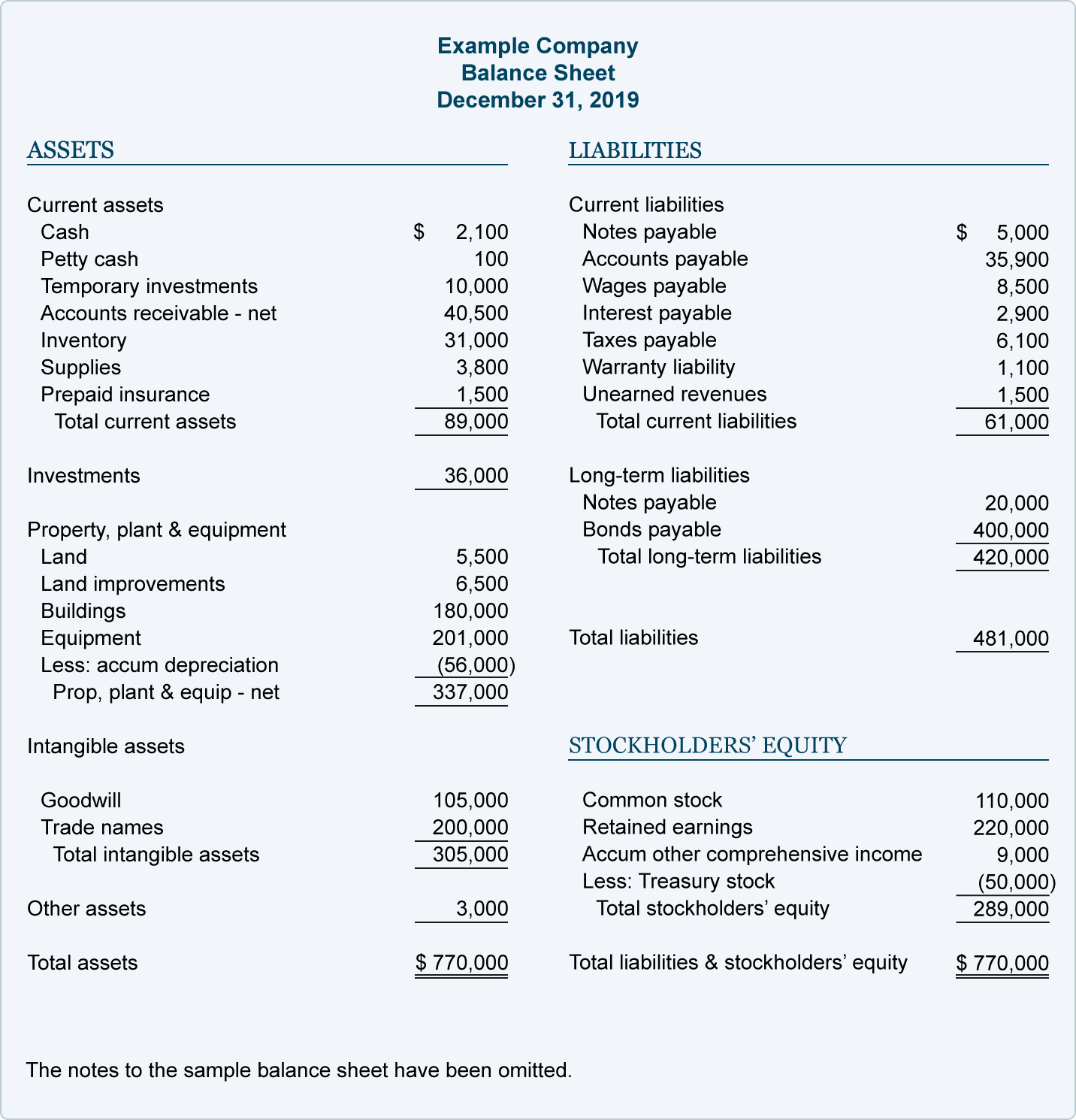

Source: Accountingcoach.com

Source: Accountingcoach.com

The balance sheet sets out the company’s assets and liabilities. These essentially tell you how financially healthy the business is.

The balance sheet includes three important factors:

Assets: Things the company owns that can be used to create economic value. Usually cash and items in your inventory.

Liabilities: What your company owes as obligations, which detract from the overall value of the business. Includes taxes and outstanding debts.

Equity: This is the value of the business to its owners (including shareholders), once assets and liabilities have been accounted for.

Equity financing is very common for modern startups. You’ll see countless examples of large Series A, B, or C investment rounds.

Read Beyond Equity, our article series on non-dilutive startup financing.

Profit & Loss (or income) statement

The P&L statement clearly sets out your company’s earnings versus its losses. It essentially gives an account of the bank balance at the end of a given period, once customers have paid you and you’ve paid suppliers.

Which makes this perhaps the most fundamental accounting document for any business.

The income statement begins with revenue - broken down by key revenue sources. For example, a software-as-a-subscription (SaaS) business might choose to include its main product packages, to show which have brought in the most business. You might equally choose to break it down by key markets, if that’s more relevant for decision makers.

Next, you itemize your main expense categories. It’s important to show whether more money goes to marketing and sales, product development, inventory, or elsewhere.

You can get as granular as you like in this exercise, but the most important line will fall at the bottom: Net Profit (or Loss). You essentially subtract expenses from revenue to show how much the company has profited or lost in a given period.

Which is how the statement gets its name, obviously.

Cash flow statement

The cash flow statement shows you how cash flows in and out of the business during a given period. At first glance, that sounds a lot like the income statement. But not exactly.

Items are recorded on the income statement to reflect the value you’ve gained or lost in a given period. But this doesn’t mean that value is liquid. For example, you might sign a huge contract with a client. The deal is done, and they are going to pay.

So this value will appear on the income statement for that period. But they haven’t paid yet. And until the payment comes in, it can’t go on the cash flow statement.

Here’s another great example from Bench:

“For example, depreciation is recorded as a monthly expense. However, you’ve already paid cash for the asset you’re depreciating; you record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life. But cash isn’t literally leaving your bank account every month.”

The cash flow statement reflects the actual cash situation. If a payment hasn’t come in or gone out yet, it won’t show up on the cash flow statement.

For this reason, a company could easily be cash-rich, but report a net loss if they’re on the hook for a few large payments. It’s essentially like taxes - the money is in your account, but it’s not really yours.

You might also have negative cash flow in a given month, but because you’ve invested in future projects, this may not be a bad thing at all.

The three key statements work together, and you’ll find lines from one in the other.

3. Bank reconciliation

To prove the information in your statements is correct - which you’ll need to do for any kind of audit - your accountants need bank statements. These statements should prove that transactions listed in your general ledger did in fact take place - as proven by your bank.

For example, suppose your general ledger shows that a customer paid you $10,000 in January. Now suppose that your bank account statements for January and February have no record of that payment ever arriving in your account.

This will show up in your cash statement, of course. And your accountant or finance team will need to investigate to see what happened. Most likely, this was a simple bank error or a mistake from the customer, but it’s important to find out.

More simply, bank reconciliation lets you balance your bank accounts against the general ledger, and keep an eye on bank fees.

4. Credit card reconciliation

Credit cards play a similar role to your bank account, but can be even more difficult to reconcile. In exactly the same way, you need to know that every card payment is accounted for in your general ledger, and that every card payment in the ledger was in fact made.

Credit cards can be harder to reconcile because, in the typical business, more people have access to them. In some startups, the company card is passed around liberally, with employees keeping the card details on Post-Its.

And with Amazon deliveries and countless SaaS services to track, the credit card statement can get long very easily. You also have to worry about receipts - often on paper - which isn’t the case for bank accounts.

In short, lots of small transactions are harder to control than less frequent, larger ones.

5. Receipts (or proofs of purchase)

On top of simply recording and balancing the company’s transactions, accountants also need to keep proof that transactions with third parties actually took place. While your credit card or bank statement does this in theory, it only does so from your point of view.

On top of simply recording and balancing the company’s transactions, accountants also need to keep proof that transactions with third parties actually took place. While your credit card or bank statement does this in theory, it only does so from your point of view.

A receipt proves that a transaction was handled and accepted by a third party - an extra level of proof often required by authorities.

Again, this is most relevant come audit time. Tax offices want to see that the financial position you claim to be in is real. Particularly when claiming expenses, which you’ll usually need to claim with a valid receipt.

What is a valid proof of purchase for business expenses?

Business expenses are mostly tax deductible. But tax authorities obviously only want to give deductions for valid expenses. And receipts help to prove that an expense did occur and was valid.

6. Accounts receivable

Accounts receivable is the term for any outstanding amount owed to you by customers. This is an asset to your business, even if the cash hasn’t arrived in your bank account yet.

Remember the difference between your income and cash flow statements, above? If you use what’s called accrual accounting, accounts receivable appear in your income statement the moment a contract has been entered into.

If you use cash basis accounting instead, you don’t record the transaction until it appears in your account. Crucially, you also don’t pay tax on transactions until they actually appear in your account. Which is why it suits many small businesses.

Particularly if you operate on a credit basis - which the majority of businesses do to some extent - it’s vital to keep on top of your accounts receivable.

Fun fact: You can even use your receivables as securities against loans. Read our guide to supply chain financing.

7. Accounts payable

Accounts payable is essentially the opposite of accounts receivable - it’s the outstanding sums that you owe suppliers. These are liabilities, a concept we saw above.

AP is most often paid by invoice, which means an extra document for accountants to keep on top of. Each transaction includes the supplier invoice, a bank or credit card statement, and then usually a receipt from the supplier.

Each of these needs to match, and your overall accounts payable balance should be reflected in the general ledger. Because these documents need to be handled correctly, invoices are often paid by a dedicated purchasing team, or are executed by the finance team themselves.

Learn more about the accounts payable process.

8. Tax

Another feature of company accounting is the way you deal with taxes. As noted above, company expenses are typically tax deductible. In some countries, companies will also be eligible for tax credits where they have a certain number of employees, if they operate in specific industries, or if they add a necessary value to society.

But as we also mentioned above, these things need to be proven. And that’s where your accountants come in to play.

Clear, error-free financial records are your best tool when dealing with tax authorities. As long as transactions are legitimate and provable - and they’re eligible for tax relief, of course - you should have no issues with filing tax returns.

This is why it’s vital to keep receipts and other financial records in a logical, accessible system.

And once you’ve filed tax returns, hang onto them. Companies can usually be audited up to three years after filing, and in many companies that timeframe will be considerably longer.

6 keys to better accounting for startups

So those were all the basics you need to have in place. But how can you actually do them well?

Startups are known for being innovative; for finding efficient new ways to grow faster. And a lot of classic accounting processes are just the opposite - slow and tedious.

Here’s how to fix a few of these issues.

1. Collect receipts smoothly

We’ve seen the importance of receipts - both for detailed bookkeeping and in the eyes of the tax authorities. But collecting receipts from colleagues is one of the most painful parts of a finance team’s routine.

Other employees don’t know the significance of good record-keeping. They probably haven’t read this article.

So your best weapon for easy accounting is to implement systems that capture receipts easily. If you make life simple for team members, they’ll make accounting a breeze.

The best way to capture receipts is with a mobile app. They take a photo of the receipt the moment they purchase something, and the receipt is recorded forever.

Another option for online receipts (from Amazon or Uber, for example), is to have a forwarding address. The employee doesn’t have to store it somewhere or attach it to a spreadsheet - they just sent it to receipts [@] company.com. Or better yet, they drag-and-drop it into your expense software.

2. Digitize documents

Directly related to the above point, is the fact that modern accountants shouldn’t be using paper at all. Paper receipts and invoices get lost too easily. Even bank account and credit card statements should be digitized these days.

If you still use physical bank statements, worry not. Modern tools let you convert bank statements to digital formats automatically, and also extract figures from PDFs to use easily in Excel spreadsheets. This streamlines the reconciliation process and minimizes errors.

This has a few key advantages:

You can access them from anywhere. If you store documents in the cloud, you can get at them even when you’re not in the office.

They’re quick to find. Well-named and categorized documents should be a simple search away.

They’re harder to lose. Particularly if staff digitize documents the moment they receive them, they’ll no longer wind up in the trash by accident.

They minimize data entry. The other giant time-waster for accountants is manually entering data from paper records. But digital documents are already digital, and your expense and accounting tools can extract the key data directly from them.

We’ve moved beyond paper in business. And it’s time that finance teams did too.

3. Avoid company credit cards

We saw above that reconciling company cards can be a lot of work. And that’s mainly because they’re not really designed to help you out.

They don’t make it easy to track payments in real time - usually you have to wait for a statement at the end of the month. And they don’t tell who exactly made a payment. They just weren’t built that way.

This is why the better option is to use employee debit cards. These have each employee’s name on them, and you can set limits and spending rules however suits. The big benefit is you always know who made a payment, and you can monitor these in real time from an app.

These are essentially the same modern cards we’re learning to love in our private lives. Only built for business, with finance teams and accountants in mind.

4. Use smart expense accounts

Another complex and tedious process is filling out that general ledger. You have different expense accounts, and each transaction needs to be assigned to the correct one. Doing this manually - looking at every transaction - is obviously not an enticing option.

The smart payment methods we saw in the previous paragraph can actually assign the expense account based on the supplier. For example, every payment that goes to Salesforce should probably come out of your sales budget. So you set this up once, and then every subsequent payment is automatically assigned to the right expense account - both in your expense tool and your general ledger.

And because you probably use the same suppliers over and over, you’re cutting down the vast majority of expense account work.

5. Automate!

We’re passionate about accounting automation, and we’ve already written plenty about it. So we won’t go into it here.

But if you’re interested, here are more resources:

6. Reduce errors from the start

One specific benefit of automation deserves its own section. It’s easy to overlook just how common human error can be in any repetitive process. Accounting is no different.

And we’re not just blaming accountants for these errors. Think about the people involved in most transactions:

Employees pay for things with company cards or using expense reports. They’re not finance experts, and quite likely don’t know the proper procedures.

Managers approve payments and oversee budgets, but they’re busy and honestly don’t have a deep interest in financial data.

Finance teams have to enter all that data. And if you’re dealing with hundreds of entries, of course some mistakes can occur.

The beauty of the general ledger design (using double-entry bookkeeping) is that you’ll most likely catch these errors. But the big issue is the time and energy it takes to correct them after the fact.

Those smart payment methods and digitized documents remove a lot of the human handling, which in turn reduces human error. And that means a lot less time at the end of the month trying to figure out why the numbers don’t match.

Get the right startup accounting processes in place

Hopefully this long post has broken down some of the most important aspects of small business accounting, and how to make them more palatable.

Your only real option now is to get started.

And of course, that doesn’t mean starting from scratch with a blank Excel file. There are wonderful tools - like Xero, among others - designed to give you all the structure you need. They’re also powerful enough that seasoned accountants can work more efficiently with their help.

Overall, the main takeaways are:

Digitize

Modernize

Automate

Startup accounting shouldn’t take days - at least not at the beginning. And it doesn’t have to be overly complex. As long as you put good, smooth processes in place.

Curious how Spendesk works?

Try an interactive demo to see spend control and approvals end-to-end.

Get a free tour

)

)

)

)

)